“Yesterday the IRS announced that obese Americans are entitled to certain tax breaks. Apparently, under the new rules, you’re allowed to claim two or more chins as dependents.” —Conan O’Brien

Taxes suck. Nonetheless, if you know the basics and make smart decisions, you can avoid handing over your hard earned dough to the Tax Man. Here are 4 steps to get you started.

1. Prepare ’em

- Figure our which form to file. 1040EZ? 1040A? 1040XYZ? OK, I made that last one up, but the best starting point in doing your taxes is to figure out which form you should file to save the most money. Which form you file depends on a range of factors (single or married, income, etc…). For a handy dandy chart to help you decide, click here.

- Decide who’s going to fill them out. For the truly tax clueless, tax preparers such as H&R Block and Jackson Hewitt can fill out simple returns and answer your questions for about $100. (A word of caution: NEVER use their service that gives you your rebate immediately. What they are really giving you is not your rebate but a loan based on your expected rebate at exorbitant interest rates.) For the DIY-ers out there, tax prep software has come a long way in the last few years. Turbo Tax and Tax Act dominate the market right now with increasingly easy to use interfaces and how to videos. Prices are low, they maintain your info from federal taxes to help you file state taxes, and you can avoid ever touching a piece of paper by filing them online.

2. Maximize Deductions & Credits. Deductions and credits reduce how much you owe in taxes. Keep in mind that if you don’t owe many taxes to begin with these won’t help you. Here are a few that are especially relevant to people in their 20s.

- In school? Hope Scholarship Credit: A tax credit for up to 100% of your first $1,000 in tuition and fees and up to 50% for the second $1,000. You’ll get $1500 max. Can only be used in 1st 2 years of college.

- In college more than 2 years? Lifetime Learning Credit: A tax credit of 20% of your tuition, room, board and expenses up to $10,000. Max is $2,000.

- Moved over 50 miles last year? You can deduct the cost of moving your body and your things to your new spot (Driving? You can deduct gas mileage, parking, and tolls). Check with your tax preparer of tax prep software to get current specs on what you can deduct and how much.

3. File ’em

For information on where to file…

Note: MSN Money reminds you, “If you’re going to college in one state and spending summers at home in another, you could have two states vying for your tax dollars.”

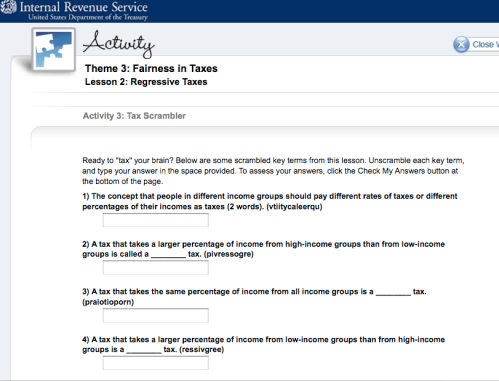

4. Celebrate! Bored w/ playing beer pong every Friday night? Check out IRS’s attempt at providing resources that are relevant to today’s youth. The 75 (No, seriously. 75.) interactive activities and games include Tax Word Scramble, and Tax Your Memory. Friday nights will never be the same.

Interesting blog, I’ll try and spread the word.

Pingback: The 3 Stupidest Ways to “Save” Money « Beyond Beer Money

Hi, good post. I have been woondering about this issue,so thanks for posting. I’ll definitely be coming back to your site.