As the recession continues and more and more people look for ways to cut back, being aware of (and cutting out) excess lifestyle inflation can be the easiest way to cut back expenses (sometimes dramatically) while getting more pleasure out of your purchases.

What is Lifestyle Inflation?

“Lifestyle inflation…is when you have more money and increase your spending to match that. It is why even with a raise, sometimes, you just don’t feel like you’re making any more progress or getting any closer to being ahead.” Source: Paidtwice.com

- I’d define lifestyle inflation as a change in the baseline of your financial life. Lifestyle inflation is the difference between a college kid whose idea of a “fancy” meal is one that doesn’t include pizza and a 30-year-old who considers a $55 restaurant tab with a friend an “average” dinner.

- Lifestyle inflation occurs when you are spending more money but are not necessarily experiencing an equivalent increase in happiness. It has implications way beyond supporting the now clichéd motto, “money can’t buy happiness.”

The US & Life Style Inflation

Years of technological advances and relative prosperity have made our lives more comfortable and convenient than the lives of people in our parents’ or grandparents’ generations. That said, studies on happiness overwhelmingly report that we are equally as happy (if not less so ) as those who preceded us.

It is puzzling because, as noted by David Myers in his book The Pursuit of Happiness, our new wealth represents not just flashier toys but safer cars, advances in life-saving medical technology, and an endless number of new ways to communicate with the people we love. That said, US citizens as a whole are not any happier than they used to be.

Recent Grads Have the MOST Problems with Lifestyle Inflation

Why?

- Because when you graduate from college you usually find yourself suddenly getting this thing in the mail every month called a paycheck. Looking at the zeroes in the check you can’t help but hear a little voice somewhere inside saying, “Goodbye eating at Burger King! Goodbye asking mom and dad for money! Hello plasma flatscreen TV and leather La-Z-Boy couches!!!”

- Because well-intentioned parents make it worse. Wanting to reward their children for hard work throughout college and ease the transition into “real life,” they subsidize rent, buy furniture for new apartments, and send periodic checks in the mail to make sure little Johnny is “still able to have some fun.” While it’s nice of them, it creates a lifestyle that’s impossible for a recent grad in an entry-level job to sustain (and, I’d argue, takes away the pride of earning and saving and proudly buying those things with your own money, but then again, even Beyond Beer Money can be old fashioned sometimes).

Why Lifestyle Inflation Sucks.

Actually, not all lifestyle inflation sucks. Some lifestyle inflation is good (you can only spend so much of your life subsisting on beer and pizza). The problem with too much lifestyle inflation is that “luxuries” become less luxurious and exciting over time.

- Surveys of the rich individuals reveal that they view as “necessities” the things most people view as relative “luxuries” (such as home cleaning services or a 2nd or 3rd car). Rather than getting more pleasure out of these conveniences, they simply take them for granted – ending up no happier than those without them. “Luxuries” need to be larger and larger to feel luxurious.

- I’d argue that many midlife crises are the result of unchecked lifestyle inflation (“I have a BMW and a large house and all the latest gadgets. Why am I not happy?”).

What You Can Do About It.

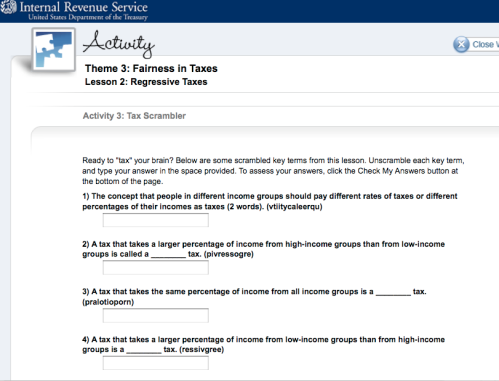

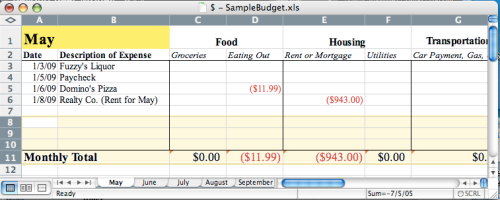

Tracking your income and expenditures (as advocated in my earlier post) is 1 way to catch lifestyle inflation. My lifestyle inflation usually appears in my “eating out” category. If I spend $80/month for several months and then see I am suddenly spending $160-200/month on eating out and am not twice as happy, it’s time to scale back.

- Who Are You Comparing Yourself To?

Lifestyle inflation often occurs not because you’re earning more money but because the people around you are spending more. Again, just be aware of it. Who are you trying to impress? (friends, co-workers, parents, boy/girlfriend) What do you get out of impressing them? (pride). Who is trying to impress you? (ironically enough, often the same people you’re trying to impress). If your friend group goes out for fancy dinners every Friday night, it’s likely that the real value is in spending time together, not in $20 appetizers. Suggest going out just for drinks instead, or throwing a dinner party at someone’s house (which is more intimate anyway).

- Try Temporarily Downsizing

Most people have a very negative initial reaction to this (“I earn my money so I should get to enjoy it.”). These people aren’t getting it. The goal of temporarily downsizing isn’t to deprive yourself, it’s to bring the excitement back to the things you spend money on.

For me, not eating out for a week or two lets me get more pleasure out of taking friends out later on down the line. Similarly, I’ve never had cable in my home because it’s not high on my priority list. Staying in hotels is thus extra luxurious for me as I catch up on all the trash TV I love but am not willing to pay for on a monthly basis.

- Calculate ”Bang for the Buck”

This is my favorite way of assessing purchases and stopping impulse buys. It’s easier than temporarily downsizing, but still a good way to remind myself that money cannot be spent twice. Bang for the buck is simply being aware of how much pleasure you get out of the money you spend on various items. It is different for every person.

I’m not a big fan of buying $8 drinks at bars. That $8 gives me a lot more bang for the buck when put toward concert tickets or travel abroad. Other low bang for the buck items I tend to forego: expensive jewelry (I worry about/lose it), books (I’d rather get them from the library and not have to store/dust them), flying 1st class, eating at expensive restaurants, staying in fancy hotels, MochaFrappa whatevers at coffee shops.

High bang for the buck items I’m willing to pay top dollar for: travel (my biggest expense category by far), North Face gear (I spent $100 on my backpack but have been using it for 8 years, ditto on my fleece), comfortable shoes (my knees are bad, so Pumas are worth every penny for me).

Your “bang for the buck” items will be different than mine. No matter what they are, by being aware of them you can cut spending in areas you get less pleasure from and funnel that money toward things you’ll really enjoy.

What are YOUR high and low bang for the buck items?

How do you deal with lifestyle inflation? Feel free to email me or comment below.